Fundraising is an essential milestone in a startup’s journey.

However, understanding the differences between Seed and Series A rounds can help you navigate the process with clarity and purpose.

These rounds serve different goals, attract other investors, and require different levels of preparation.

Here’s what you need to know:

1. What Is a Seed Round?

The Seed round is your startup’s first official fundraising step. It’s designed to get your idea off the ground.

Purpose:

- Validate your product idea (build an MVP).

- Conduct initial market research.

- Acquire early users or customers.

Investors:

- Friends, family, angel investors, and seed funds.

- Focused more on your vision and team than on financial performance.

Funding Amount:

- Typically ranges from $50,000 to $3 million, depending on your industry and geography.

Equity Given:

- Usually between 10–25% of your company, depending on the deal structure.

Key Metrics to Highlight:

- Strong team and domain expertise.

- Early traction, even if minimal.

- A clear problem-solution fit.

2. What Is a Series A Round?

The Series A round is about scaling what works. It’s typically raised once you’ve validated your product and shown early traction.

Purpose:

- Scale your product and customer acquisition.

- Hire key team members (sales, marketing, operations).

- Optimize your business model.

Investors:

- Venture capital firms and institutional investors.

- Expect to see a clear path to revenue and market growth.

Funding Amount:

- Typically ranges from $2 million to $15 million, though it can be much higher in competitive industries.

Equity Given:

- 15–25%, depending on negotiation and valuation.

Key Metrics to Highlight:

- Consistent revenue growth or strong user engagement.

- Product-market fit.

- A scalable business model.

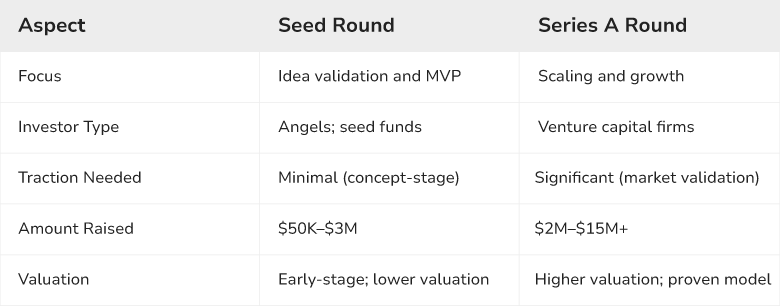

3. Major Differences Between Seed and Series A

4. How to Prepare for Each Round

Seed Round Preparation

- Create a compelling pitch deck that focuses on the vision and potential.

- Showcase your MVP or prototype, even if it’s basic.

- Highlight the team’s strengths and why you’re uniquely suited to solve this problem.

Pro Tip: Emphasize the size of the market and your potential to disrupt it.

Series A Preparation

- Build a robust financial model to demonstrate scalability.

- Prepare detailed KPIs such as customer acquisition cost (CAC), lifetime value (LTV), and revenue growth.

- Show evidence of a strong, repeatable business model.

Pro Tip: Be ready to discuss long-term strategy, including how this funding will position you for Series B.

5. Common Challenges Founders Face

- Seed Round:

- Overvaluing your startup too early can scare off future investors.

- Raising too little can leave you short on the runway to achieve traction.

- Series A Round:

- Without clear growth metrics, it’s hard to attract VCs.

- The scrutiny on scalability and team performance is significantly higher.

6. When to Move from Seed to Series A

You’re ready for Series A when you’ve achieved:

- Product-market fit (users are actively engaged and/or paying).

- Predictable and scalable revenue growth.

- A clear roadmap for scaling with funding.

Red Flag: If you’re still experimenting with your product, it’s too early for Series A.

Key Takeaways →

- Seed rounds focus on validating the idea; Series A is about scaling a proven concept.

- Each round requires tailored preparation, especially in terms of metrics and storytelling.

- Understanding the distinct expectations of each round helps you pitch effectively to the right investors.

P.S. Fundraising is a marathon, not a sprint. Focus on building relationships with investors early—they’ll often stick with you from Seed to Series A and beyond.